Why Should You Work With Us?

Fast, Hassle-Free Process: We navigate the complex funding landscape for you, getting capital quickly without mountains of paperwork.

No Upfront Costs: You pay nothing until your funding is approved and in your account.

Flexible Funding Options: Access up to $100,000 with 0% interest, giving your business the breathing room to grow.

If you have:A 680+ credit score

At least two primary credit cards with $2,500+ limits each (or one with a $5,000 limit)

Exclusive Banking Network: Our trusted relationships with bank managers mean faster approvals and higher funding limits.

Startups Welcome: Even if you’re new with no revenue, we can help if you have a solid credit profile.

Risk-Free Service: If we don’t deliver funding, you don’t pay simple as that.

Real Client Testimonials

Cameron Secured $50,000 For His E-Commerce Business!dline

Funding Made Easy in

3 Simple Steps

Get the Cash You Need in Just 3 Simple Steps

Step 1

See If You Qualify by Clicking the Link Below

Step 2

Get the Funding You Need — With Zero Upfront Costs

Step 3

Use Your Money to Start or Scale Your Business. Yes, it is This Easy!

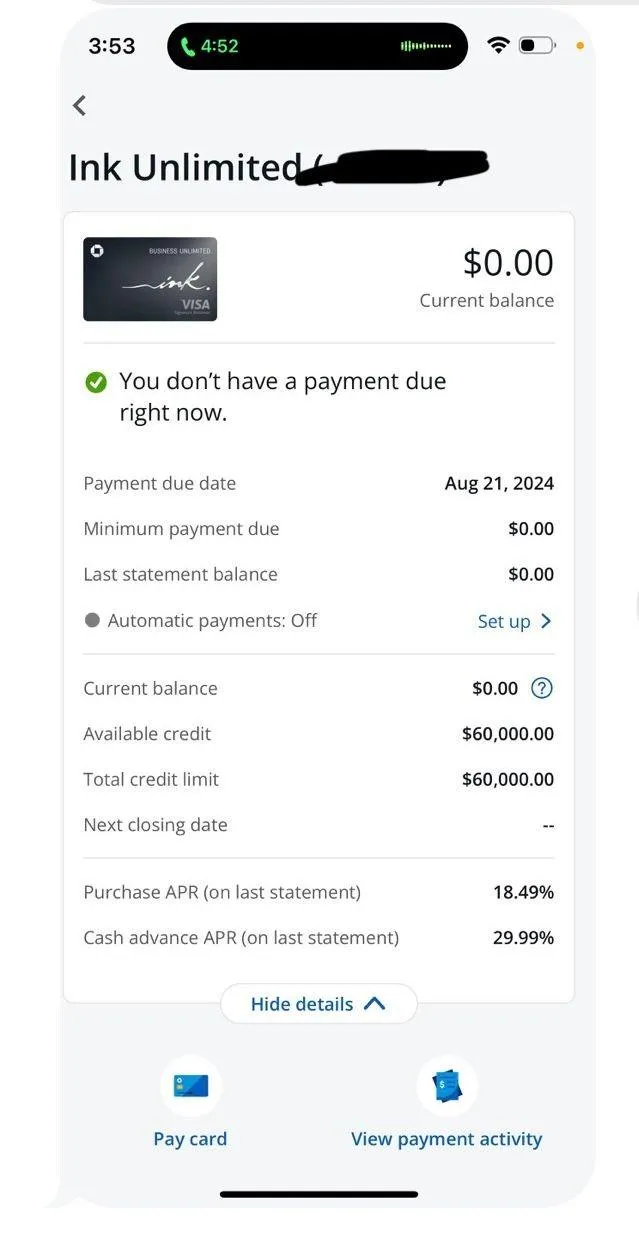

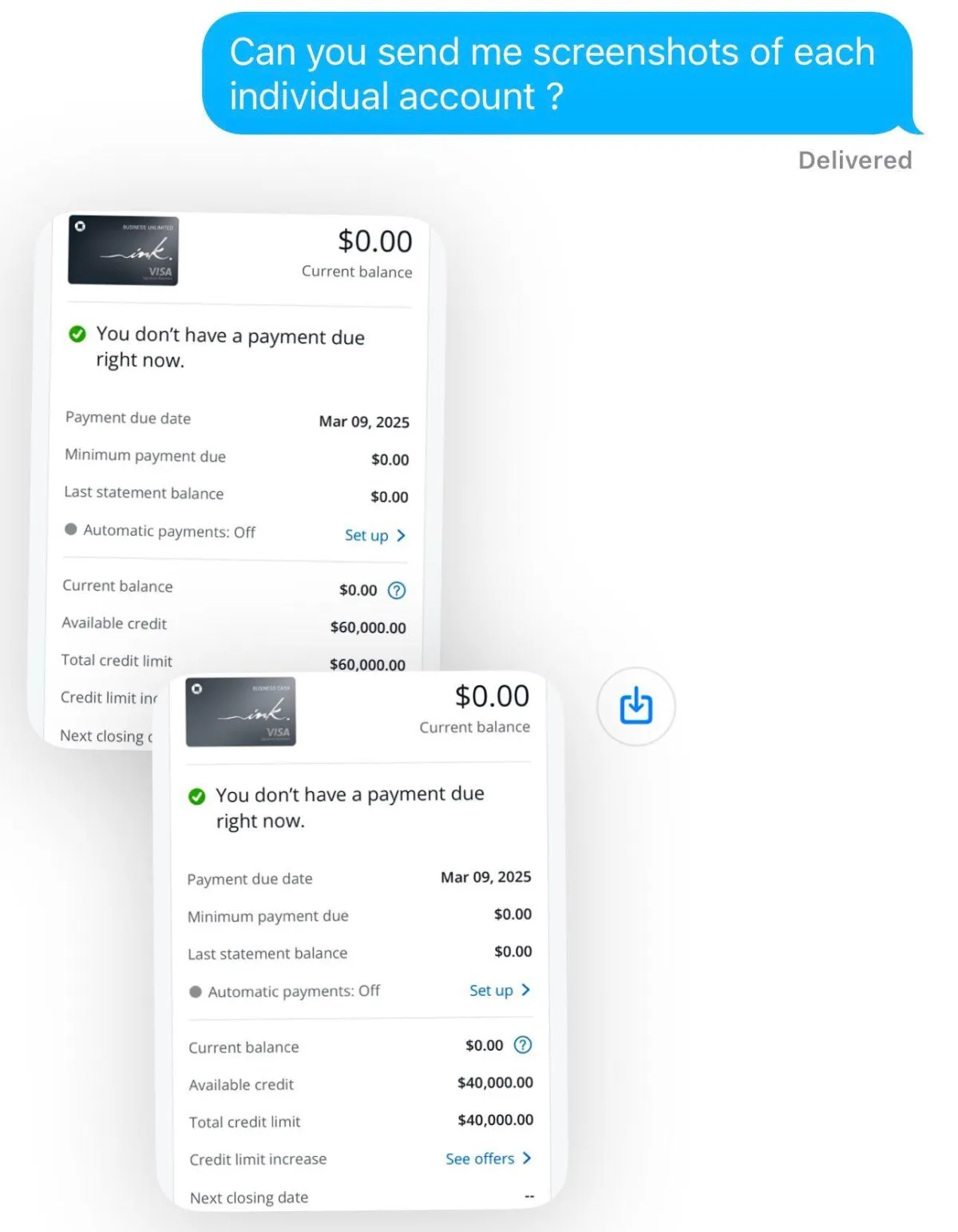

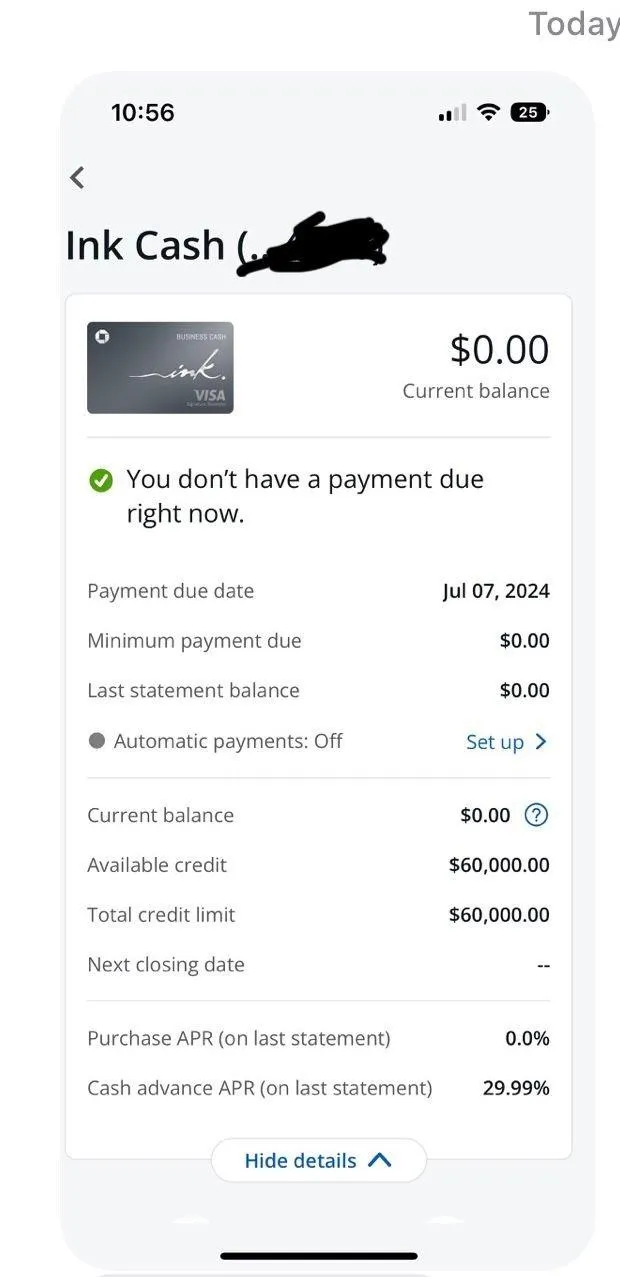

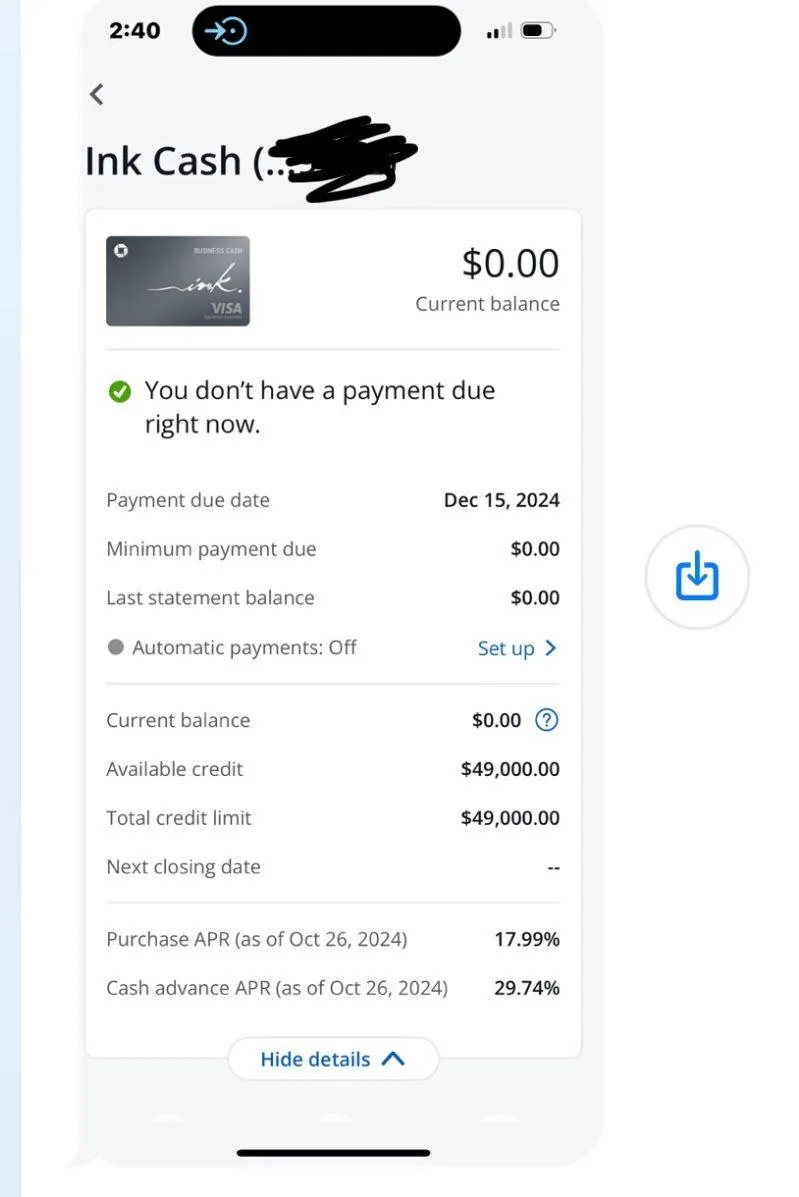

The Approvals

About

STEEL CITY GROUP

Hi, I’m Makayla Flood. Back in 2021, I was fresh out of college, unemployed, and searching for a way forward. When the demand for PS5’s and Xbox Series X’s exploded, I saw an opportunity. I didn’t have the cash to start, so I turned to high-limit credit cards to fund my first purchases.

What began as a small flipping hustle quickly snowballed — within a few short years, I built a 7-figure Amazon business. From there, I ventured into real estate, growing a 6-figure house flipping business and building a 7-figure rental portfolio.

The common thread through all of it? 0% interest business funding.

I know exactly what it feels like to have big ideas but lack the capital to bring them to life. My mission now is to help other entrepreneurs break through that same barrier — and turn their visions into thriving, profitable businesses.

Frequently Asked Questions

How long does credit repair take?

While each case varies, the majority of clients observe results within 14 to 30 days. Disputes involving late payments generally require 3 to 6 months to resolve, except when they pertain to closed accounts, which can typically be addressed within 14 to 30 days.

What if my credit doesn’t improve?

If we don’t remove at least one negative item within 120 days, we’ll give you a full 100% refund—guaranteed."

Is credit repair legal?

Yes, credit repair is a legal process, and we fully comply with all required regulations.

Is complete negative item removal possible?

Although regulations prohibit guaranteeing complete removal, we employ aggressive strategies to effectively dispute and eliminate collections, bankruptcies, charge-offs, late payments, student loans, repossessions, and other negative items.

Take Control of Your Business Financing Today

With our 0% interest business credit card funding program, you can unlock the capital necessary to grow your business faster, smarter, and more affordably. Don’t let funding obstacles stall your progress—apply now and start fueling your business success with interest-free capital.

STEEL CITY GROUP, LLC

Mon - Fri | 8:00 am to 6:00 pm EST

(740) 338-1352

©2025 Steel City Group, LLC, All Rights Reserved.

Instagram